About CIRT

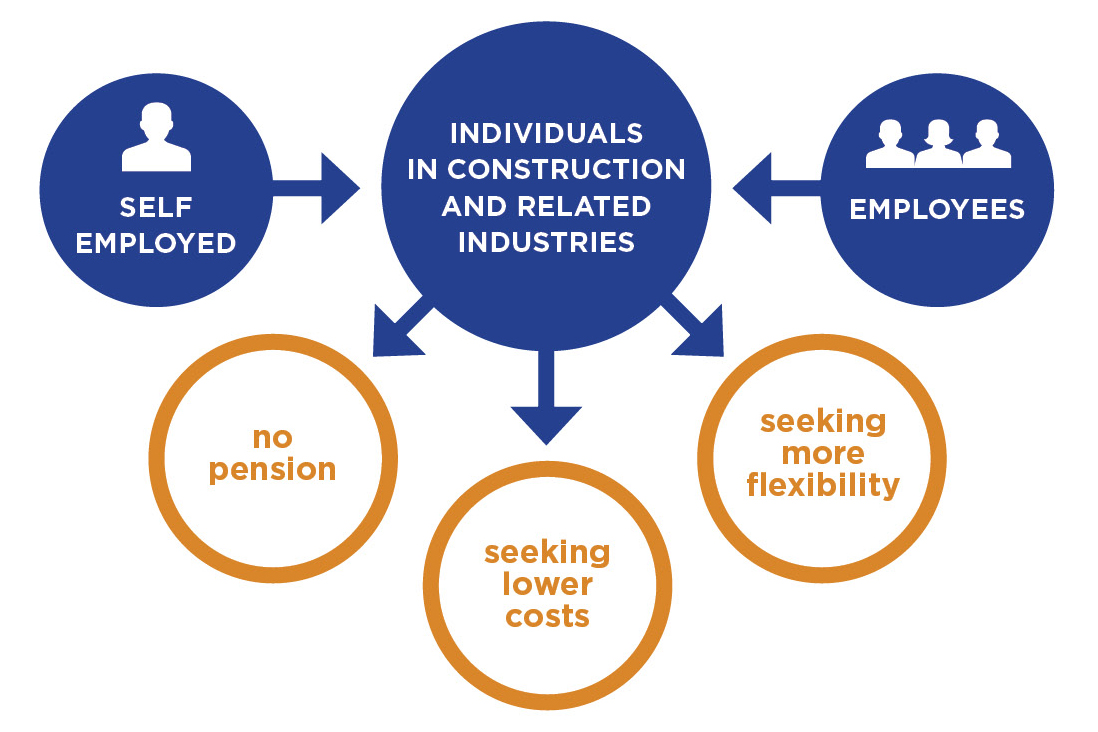

The Construction Industry Retirement Trust Scheme (CIRT) was established over 30 years ago on 1st March 1991. The objective of CIRT is to cater for self-employed individuals and employees with no pension provision in place, who are employed within the construction and related industries.

CIRT is specifically designed to provide a tax-efficient way of saving for your retirement. As CIRT is approved by the Revenue Commissioners, you will enjoy valuable tax concessions as a member. You will also be able to choose a range of options on your retirement. You can download the CIRT brochure here.

Who can join CIRT?

You can join CIRT if you are under the age of 70 and are:

Self-employed individuals who are employed within the construction and related industries

OR

Employees with no pension provision in place, who are employed within the construction and related industries

If you wish to join CIRT download and return the CIRT Membership application form here.

The Administration Team

Construction Industry Retirement Trust Scheme (CIRT)

Linden House,

4 Clonskeagh Square,

Clonskeagh Road,

Dublin 14,

D14 FH90.